.png)

From all of us at Oxford Planning Group, we hope you have a safe and wonderful holiday.

We are blessed to live in such a wonderful country.

.png)

From all of us at Oxford Planning Group, we hope you have a safe and wonderful holiday.

We are blessed to live in such a wonderful country.

Summer travel!

We all look forward to getting away from it all. Summer means trips and family time – but don’t forget to take precautions at home and while you’re away to secure physical and digital devices.

At home

Back up all devices either to local storage or cloud services protected by strong encryption. Use password security on all devices and specify a number of failed attempts before lockout.

Don’t post details of your adventure while you’re away – it’s so exciting to share with everyone, but wait until your adventure is over before sharing.

Physical security

Stolen wallets are a traveler’s nightmare. Minimize potential dangers by carrying only essential items. Invest in a money belt or pouch that can be concealed under clothing.

Take photos of all important documents like credit cards and passports and store them in an encrypted format such as a cloud service. This will give you access to basic forms of identity in the event of theft.

Laptops are vulnerable to theft – consider if you really need to bring one. If you do, it’s best not to have information stored on the device that could be stolen (personal financial info, etc.)

Public Wi-Fi – be careful!

- Be sure your firewall is active and up to date

- Don’t use banking and shopping sights

- Email is the most important service to secure – criminals can use your email to reset passwords on other sites

- For an extra layer of security, CNet suggests subscribing to a public VPN service (it sets up a secure channel between you and sites you connect to, protecting data with strong encryption). Most plans are under $15 a month

Security shouldn’t stop the fun – consider it part of your vacation plan to really allow you to unwind!

Source: AARP

Do you have a plan for Long Term Care?

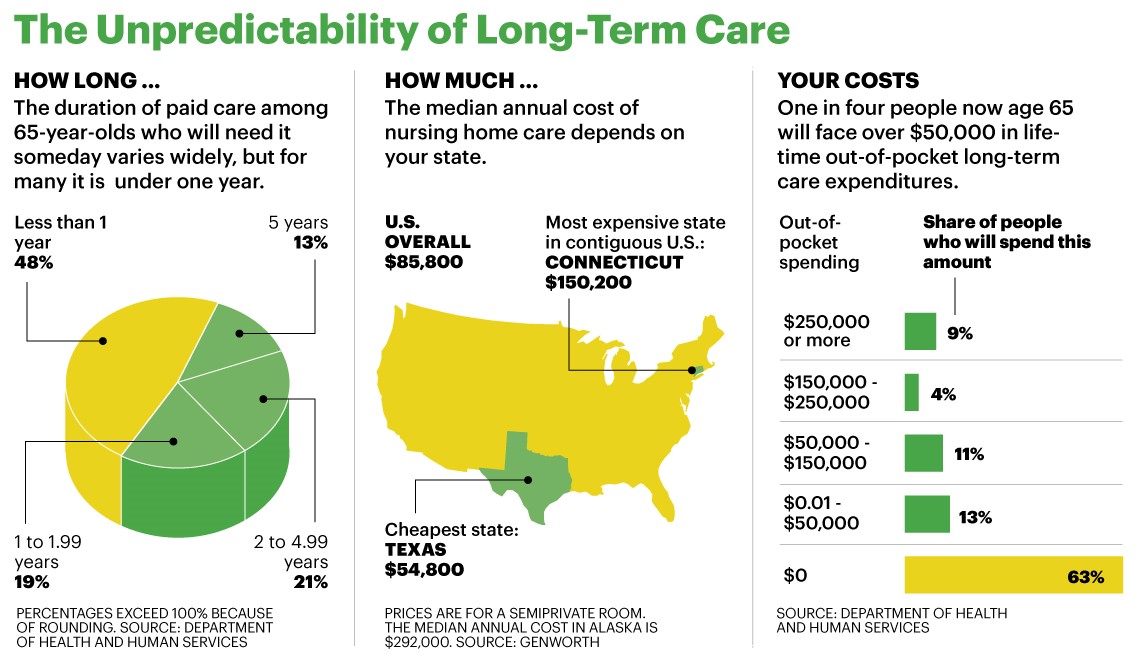

As we age, or in the event of a medical event, we may need Long Term Care. Surprisingly, a large percentage of people have no plan for such an occurrence. Additionally, many people believe that health insurance or government programs such as Medicare will pay for these needs. Sadly, that is not the case. Lack of planning in this area can be a major financial burden for families. In addition, this lack of planning puts a heavy strain on community and social service programs that are not funded or designed for this purpose.

In 2017, I was appointed by Governor Hogan to a Task Force on Long Term Care. The purpose of the Task Force was to make recommendations for better education around Long Term Care. Unfortunately, many families are unware of what may lie ahead for their Long Term Care needs. Over 70% of all people will require some form of Long Term Care services in their lifetime. This may be very short-term care or care lasting the remainder of their lives. In order that families are better prepared for this, our task force was assigned to review education around the topic and to recommend ways to help people be more prepared.

It all starts with having a plan. While there are many components of an overall financial plan, this blog focuses on planning for Long Term Care. So, what’s in a plan?

This article by Kiplinger “Why Families Need a Plan for Caregiving” discusses some considerations faced when planning for Long Term Care.

First, should you need any kind of care, where do you want to receive that care? The answer is not the same for everyone, but many people would prefer to receive care in their homes initially.

Questions to consider:

Next, it is important to review what financial resources will be available for Long Term Care.

We recommend beginning planning early. This will give you the most time to begin saving ahead of time, to review insurance costs and eligibility and to have ongoing discussions with family members. Whether you need Long Term Care or how much Long Term Care you need will vary greatly from person to person. In this case, averages don’t always serve you best. If you are the person who needs full time Long Term Care, you will be grateful if you have a plan in place.

At Oxford, we continually strive to provide the latest technology and tools to help provide the best financial planning and investment planning possible. Most of the time we do the planning and provide all of the reports. Occasionally, our clients ask if there is a simple way they can “play" with some of the calculations. This is where we can point everyone to the calculators on our website. These can be found under our "Resources" tab under "Calculators".

As a firm, we are here to serve our clients and to help them achieve their goals and to take the responsibility of managing these areas off of their plates. We feel this approach has been rewarding for both ourselves and our clients. For those times that you want to try “what if” scenarios yourself, these calculators can be helpful. On this screen you will find loan calculators, lease versus loan for a car, retirement plan calculators and much more. Enjoy. These tools can be helpful to brainstorm and experiment. You might also find these tools useful with children and grandchildren who are looking for ideas.

As always, we are here for you at any time and are always excited to run projections and help work through ideas. We also love to meet new family members, so please let them know that in addition to the tools, we are always happy to talk with them further.

Stocks Closed At A Record High

The Standard & Poor’s 500 stock index closed Friday at a new all–time high, ending

Slick TV ads often make financial planning and wealth management sound simple, but it’s usually

10713 B Birmingham Way

Woodstock, MD 21163

Phone: 410-995-8711

shaun@oxfordplanning.com